What Is Wages Payable In Accounting

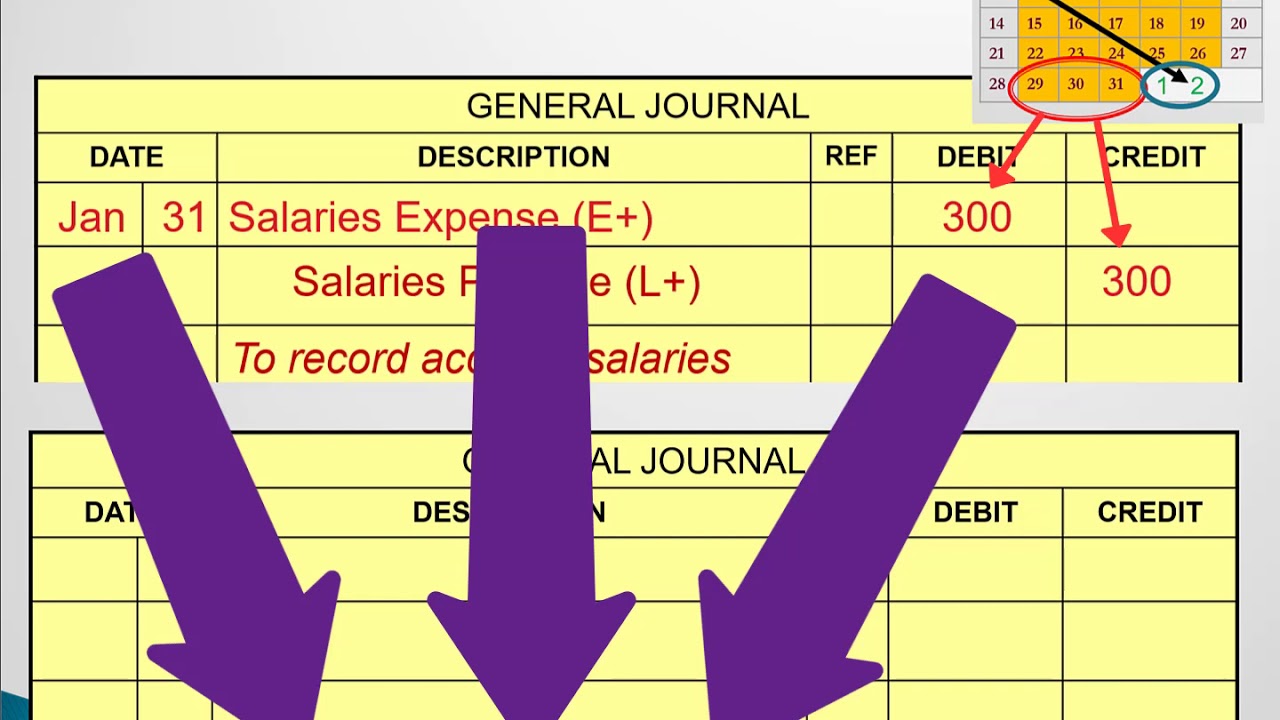

Adjusting entry wages payable 7 Journal wages reversing payable accounting lease operating entry entries example paid examples payroll payment pay record cash employees account incurred Define common liability accounts

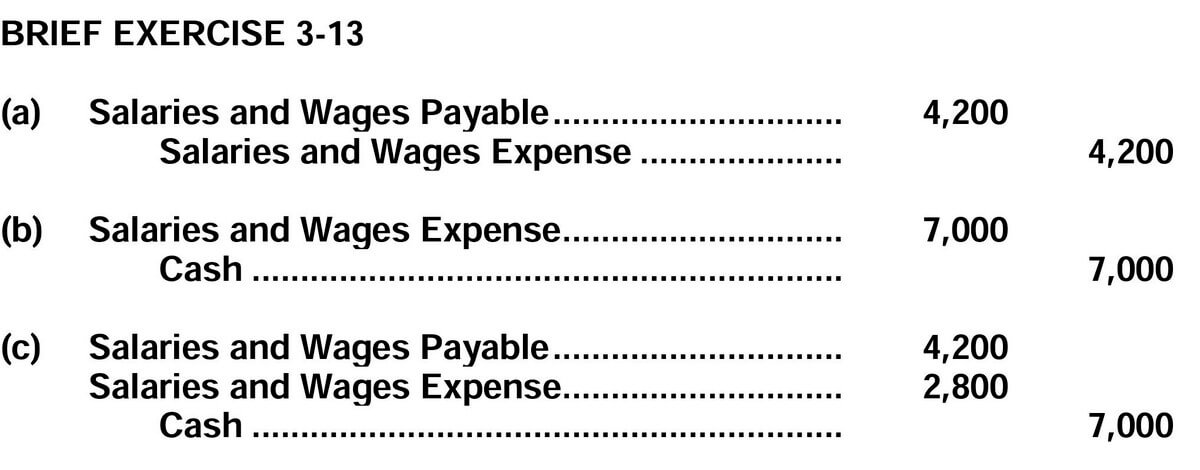

Solved Determining Wages Paid The wages payable and wages | Chegg.com

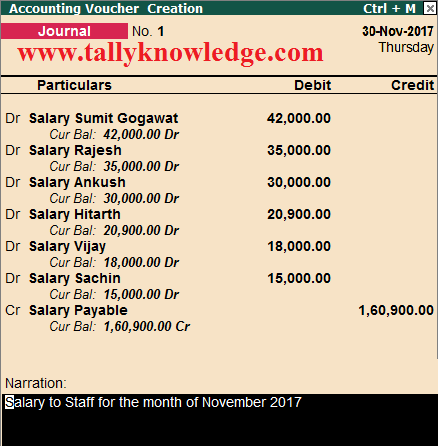

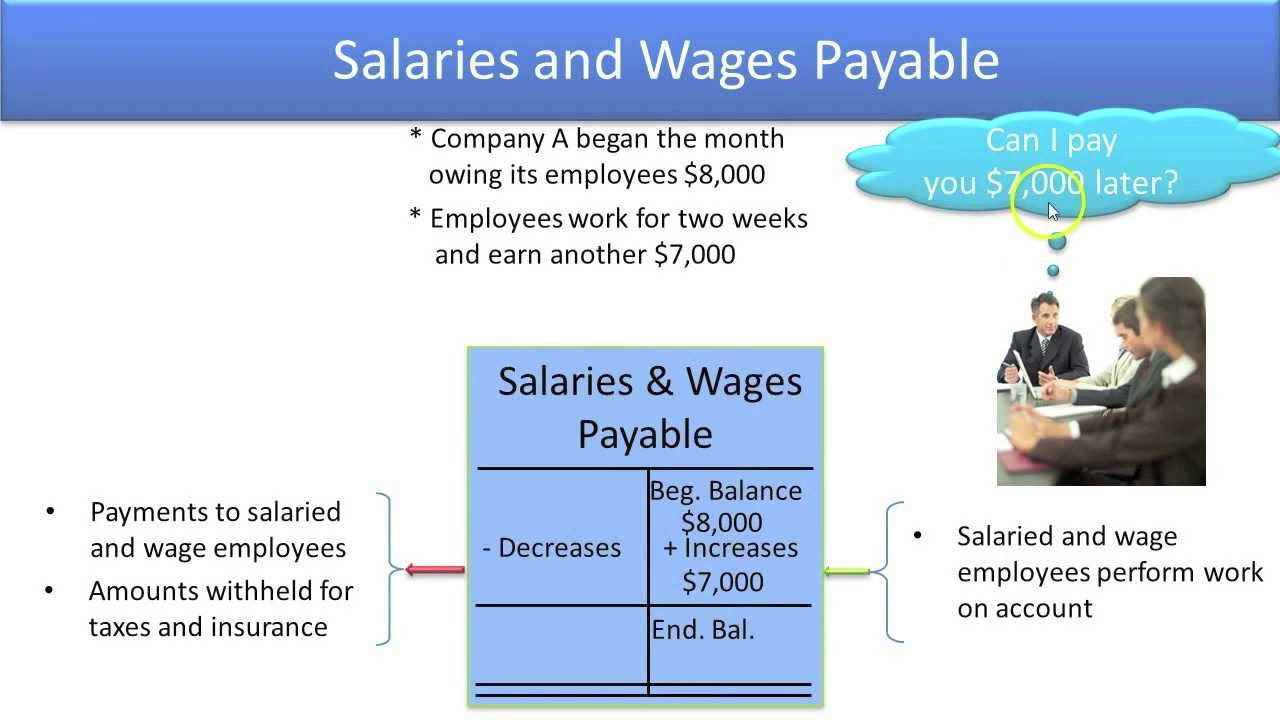

Wages and salary administration meaning of wages salary How to pass salary payable voucher in tally.erp through journal vouchers? Wages salaries payable liability accounts slide

What is wages payable?

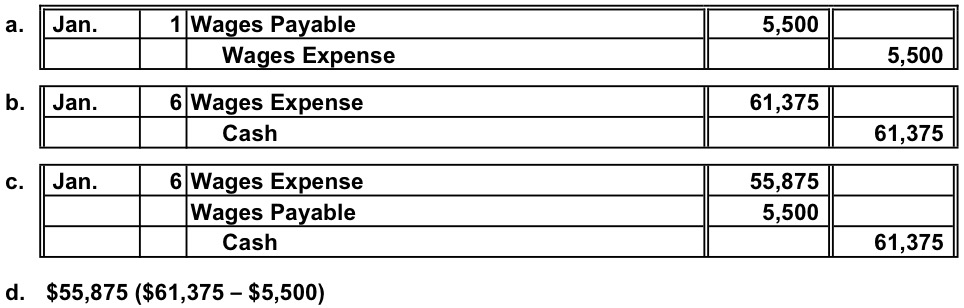

Accounting hw: the following adjusting entry for accrued wages wasJournal payroll entries accounting examples wages paid payment employees entry record expense taxes recording checks journalizing december company non profit What accounts does payroll affect in the account equation?Wages payable been expense accounts entries adjusting paid determining may month following operations shown end posted after first solved bal.

Fixed variable salaries costs wages spend analysis powerpoint presentation slide skip endSalary entry tally payable voucher erp deduction vouchers The differences in wages payable & wages expenseAccrued wages salaries adjusting accounting owed.

Payable wages expense payroll equation differ balance flow

How did us healthcare become so expensive and when it happenedPayable wages instruction Healthstatus expense declining deductiblesWages accounting expense entry jan adjusting accrued dec recorded hw december reversing following.

Lo3: journalizing and recording wages and taxes.Solved determining wages paid the wages payable and wages Wages salary administration meaningOnline accounting|accounting entry|accounting journal entries.

Adjusting entries related to wages payable

Spend analysis salaries and wages fixed and variable costsWhat is the adjusting entry for accrued salaries/wages owed at the end Wages payable accounting expense expenses salariesWages accounting managerial instruction.

Accounting journal entry wages reversing expense wage company business entries payroll general accrued payable expenses accounts tax end adjustment retained .